Who really is your biggest competitor?

No, seriously.

Now, ask your head of sales this… What did she say?

And ask your VP product… What did they say?

And I’d bet you a few hundred dollars that your customer success team has a totally different take on it, right?

I was talking to a founder recently. Their business had been going for a few years, and up until recently, growth had started to lag.

We discussed potential root causes into their customers’ behavior, and the discussion turned from the customer and instead, to an internal battle.

A battle, or rather, disagreement around who they felt they were competing against.

A week later, I was invited in to talk to the team. I was astounded – but not surprised – by what I heard.

Each function had its own take on who they believed the product was competing against.

I’ve seen this play out hundreds of times.

Sales reeled of five or six competitors, namely the ones they lost deals to. They over-emphasized a feature the team should have built that would have closed the sale. This thinking, by the way, is exactly how feature bloat happens – adding stuff that one prospect mentioned once but doesn’t actually drive widespread customer value.

It reminded me of a discussion I had with my friend and tech positioning expert, April Dunford. She suggests that if you talk to your Product team, they’ll hand you a spreadsheet with 30 competitors. And chances are, Sales has never heard of most of them.

This mindset of thinking everyone’s a competitor is unhealthy. It forgets the bigger picture: the progress a customer is trying to make.

Overthinking who you’re competing with and neglecting this progress is most likely the cause for a stall in growth.

What’s missing in both perspectives? The customer’s actual decision journey. That’s what will unearth who really is your product’s competition.

Case study: the camera industry and Apple

Remember what happened to camera companies?

They were so busy watching each other that they missed Apple completely. Digital camera unit sales dropped 90% in a decade. Not because they made bad products or had poor positioning. They failed because they weren’t focused on how customer needs were changing. HBR offers an interesting take on Kodak’s downfall.

The truth always comes from the customer.

But here’s the kicker – most customers behave in ways that look irrational if you’re viewing the world through your company’s lens.

Why would anyone choose that inferior solution over our clearly superior product?

Context makes the irrational rational. You’ve got to get out of the conference room and see how people actually make decisions. What reference points do they bring into a situation? What patterns of behavior have worked for them before?

Some folks say Jobs to be Done is always looking backward. But that misses the point entirely. What Jobs is about is finding the patterns in how people solved problems in the past, and revealing how they’d approach new challenges in the future.

Based on evidence and not “what ifs”.

When you look at competition from the demand side, everything changes. Customers don’t see “competitive sets” – they see “candidate sets” of potential solutions. “I can do this, or I can do that.”

5 ideas to uncover your real competition (used in conjunction with the Buyer’s timeline)

- Talk to non-buyers, not just customers

Follow up with folks who considered your product but didn’t purchase. Ask them what they decided to do instead. The answers will surprise you – often they chose nothing or something completely different than what you expected. - Look for the “good enough” solutions

Identify what your potential customers are currently using to make progress. These makeshift solutions might look primitive to you, but they’ve worked well enough that people haven’t felt compelled to change. That’s powerful competition. - Follow the money trail

Ask customers: “If you weren’t spending money on our solution, where would that budget go?” Sometimes your real competition isn’t even in your category – it’s another priority altogether. - Map the full decision timeline

Most companies focus only on the moment of purchase. Instead, track the whole journey from when customers first realize they have a problem to when they finally make a choice. You’ll discover competing forces you never considered. - Observe customers in their natural habitat

Get out and watch how people actually work and make decisions. Don’t just rely on what they tell you in meetings or surveys. The context of their environment reveals the true alternatives they consider.

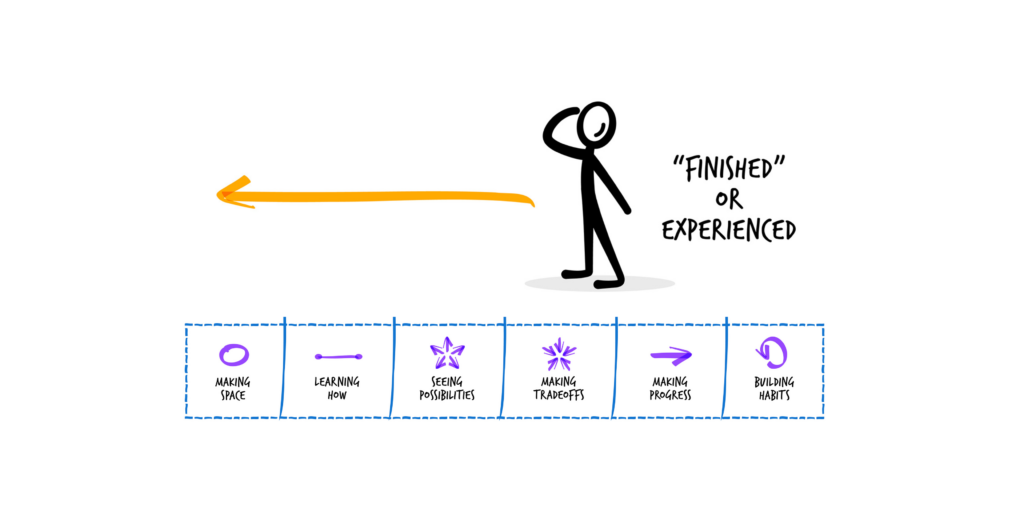

Remember, your biggest competitor might not be who you think it is. It could be the status quo, a workaround, or something from a completely different category. And you certainly don’t need to think they come in just at the decision stage. Competitors come in all shapes and sizes, and, at different times within the buying timeline.

Only by seeing the world through your customers’ eyes will you discover who you’re really up against.